Google is now the most-visited website in the world, makes Google Android, the most popular operating system in the world, is the most profitable advertising business in the world, and its parent company Alphabet is now worth $543.3 billion.

BOOM

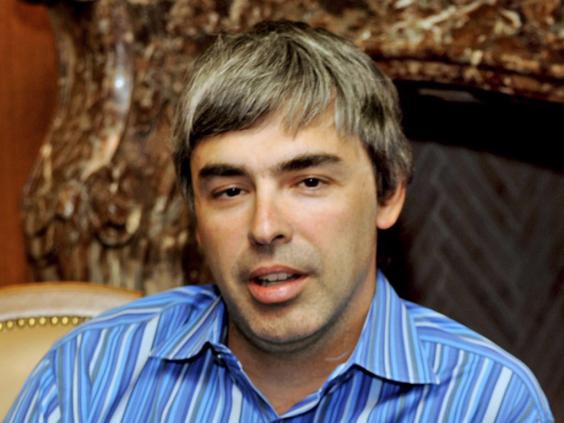

Larry Page and Sergey Brin, 2 Stanford PhD students, started Google in 1996.... incubating "BackRub," a revolutionary search engine that used a technology called "PageRank" that would rank web pages based on how many other web pages linked back to them.

|

| (Bloomberg Game Changers) |

Bakrub rebranded "googol," or the number one with a hundred zeroes before it, better reflected the amount of data they were trying to sift through.

Goog01 morphed into "Google"

|

| (Google) |

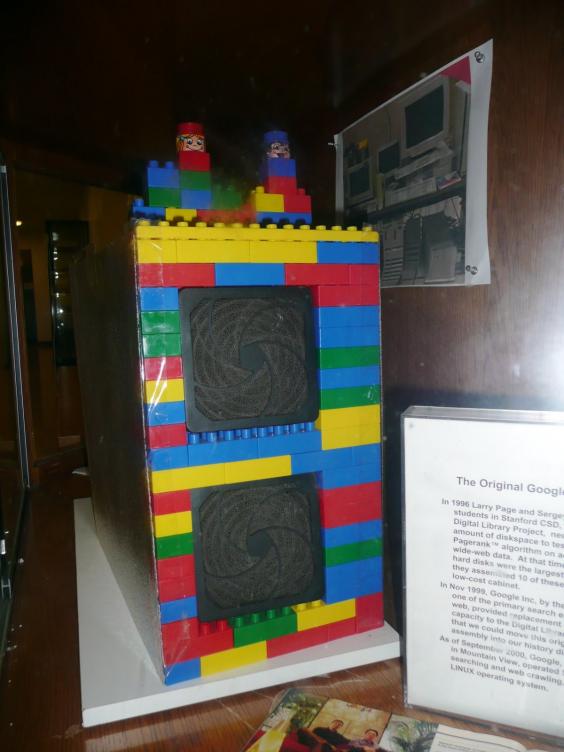

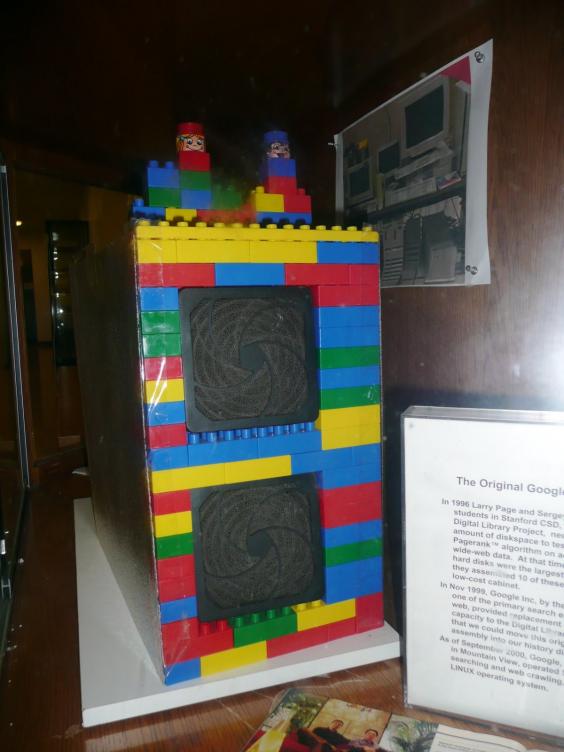

The first-ever Google server was built in a custom case made out of Legos and housed on the Stanford campus, at google.stanford.edu, and the Google.com domain name was registered a year later on September 15th, 1997.

|

| (Wikimedia Commons) |

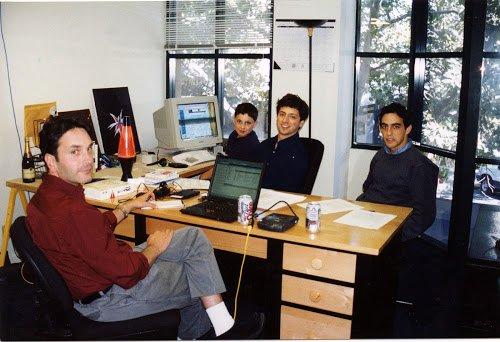

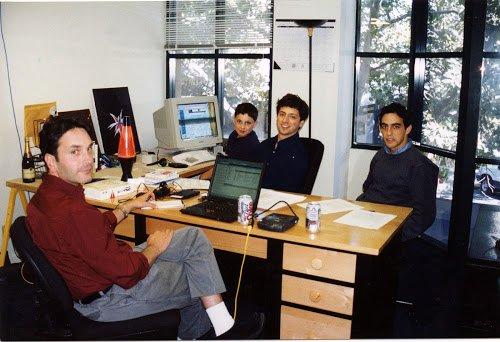

After using too much of Stanford's bandwidth, Page and Brin relocated to the garage of Susan Wojcicki - googles 1st employee, after getting $100k seed investment from Sun Microsystems founder Andy Bechtolsheim.

Google officially incorporated on September 4th, 1998.

|

| (Wikimedia Commons) |

Google's first homepage was a bit clunky where their focussed efforts wereon the algorithms that made it run.

|

| (Google) |

In 1999, Excite was in negotiations with Google to acquire it for $750k but the the deal fell through and later that year , Google moved into its first-ever office at 165 University Avenue in Palo Alto — the same office building that housed companies like PayPal and Logitech.

|

| (Google) |

Google then raised its first round of venture capital funding in the form of a $25 million investment from Kleiner Perkins Caufield and Byers and Sequoia Capital. (3 years from inception) .

How key was it for google to be in an incubated space? Was this a critical factor in its $25m series A?

Google debuted its AdWords product in late 2000, generating revenue, protecting the from the dot com bust! Brin and Page were becoming rock stars in the tech community for succeeding where everybody else failed.

Google had an awesome corporate philosophy:

"Don’t be evil. We believe strongly that in the long term, we will be better served — as shareholders and in all other ways — by a company that does good things for the world even if we forgo some short term gains."

|

| (Tangi Bertin/Flickr) DOnt Be Evil - Be Nice! |

Eric Schmidt became the first CEO in 2001, leaving the founders free to focus on Google's technology.

|

| Eric Schmidt (Getty Images) |

In 2003, Google leased its Googleplex campus from Silicon Graphics and in 2006 (10 years on) bought the building.

|

| (Google) |

The Googleplex became a symbol of Silicon Valley success. Google worked at making an awesome environment, offering free meals to its employees.

|

| (Flickr/Dmitry Alekseenko) |

August 19th, 2004, Google had its initial public offering on the stock market, priced at $85 per share. Today, a share in Google parent company Alphabet costs over $800.

10X

On April 1st, 2004, Google launched Gmail,

|

| (Biz Stone) Gmail Launched |

In fact, after the IPO, Google set its sights on expanding past the search engine. Google started gobbling up startups to launch new products like Google Docs and Google Maps, Android, YouTube

Acquisition Trail

2006 also saw Google buy up YouTube, a brand-new video-sharing site that was founded by a bunch of ex-PayPal employees. Google paid $1.65 billion in stock for YouTube.

Google was getting bigger and bigger.

In 2006, Google opened up its first wholly-owned and designed data center in The Dalles, Oregon, on the banks of the Columbia river, squeezing out incredibly high levels of efficiency from its data centers with inventive new designs.

|

| data center in The Dalles, Oregon (Google) |

Google had become the generic word for "searching the Internet." And in June of 2006, the verb "google" was added to the Merriam-Webster Dictionary.

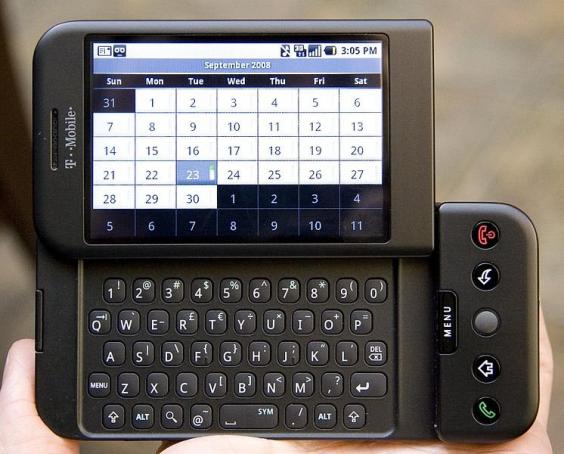

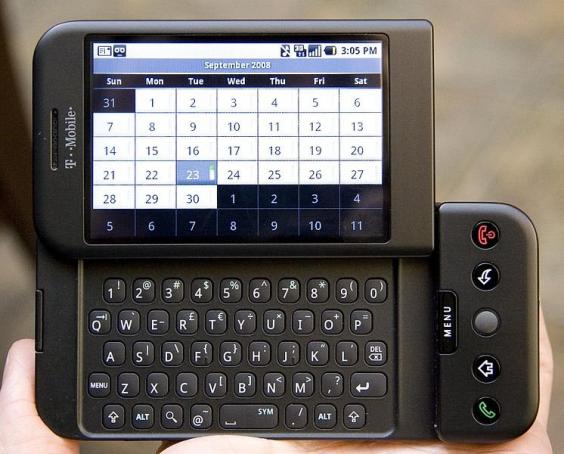

In 2008, the first-ever Android smartphone that consumers could buy. Today, Google Android is bigger than Apple IOS

|

| (Wikimedia) 1st Google Android |

In 2008 Google Chrome was created, a web browser that integrated tightly with Google's growing roster of web services. Google wanted to make sure that on every device, you keep using Google — and looking at Google ads.

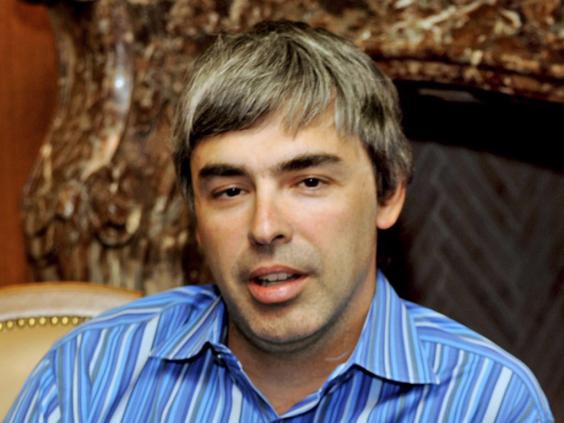

In 2011, Schmidt stepped down as Google CEO, and Larry Page became the new CEO of Google.

|

| Larry Page (EPA) |

In 2010, Google announced that it was working on driverless cars.

|

| Driverless Car (Google) |

In 2012, Google announced Google Glass

|

| Google Glasses (Getty Images) |

And recently, google restructured so Google became a wholly owned subsidiary of Alphabet, leaving Sundar Pichai in charge of the whole company, guiding Google into artificial intelligence.

|

| Sundar Pichai has become Google’s new chief executive (AP) |