2021 has been a record year for Australian Venture Capital Company, as Square Peg close the year with its investee, ROKT planning a 2023 IPO on the back of an Australian fundraise USD$325m, valuing the company at USD$1.9B.

Close to US$5bn has already been invested into Australian and Kiwi startups, including rounds in the likes of Canvavalued at $40B and Airwallex US$5.5bn.

Emerging success stories like Immutable, Mr Yum, Linktree and Octopus Deploy raised Series A and B rounds all north of US$45m.

With Seed stage companies such as Carted, Delegate Connect, and others raising early rounds larger than US$5m.

Exits, Mergers and Acquisitions

Australian tech businesses have become attractive acquisitions for established overseas players, with A Cloud Guru’s US$2bn sale to Pluralsight and Square’s US$29B acquisition of Afterpay

Square Peg is building a community of its investees that include Canva, Airwallex and Rokt, Zeller, Athena, Aidoc, Deputy, Fiverr, Tomorrow, FinAccel and PropertyGuru.

The likes of Atlassian (market cap ~US$90bn), Canva (recent round at US$40bn valuation), SEEK (market cap ~US$10bn), and WiseTech (market cap ~US$12bn) - have been at the forefront of a strong Aussie Innovative Ecosystem , attracting more capital and more importantly top talent

Capital and Venture Capital Available

Offshore capital is flooding into the market with new funds popping up weekly - investing in more and more companies with significant valuations ($50-100m valuations are not uncommon)

Over US$3bn has flowed into Australian startups in the third quarter of 2021, from less than $300m in 2013 (when Square Peg was founded) - and a lot less prior.

Today, Australia has emerged as an important ecosystem on the world stage with an active angel community, early-stage investors, growth investors, secondary funds, venture debt providers and offshore investors - providing an environment for founders to access money, resources and markets.

An ecosystem has been created with a number of support networks that bring the industry together.

The brief history - We have come a long way

When BSI was hosting its investor forums between 2003 and 2008 - we would showcase 8 emerging companies every 4 months to 35 potential investors in Sydney , Melbourne and Brisbane (Google bsivc )

Capital raising for startups was hard - startups, and there were limited resources or mentors for founders and operators to help them scale their businesses. Very few people understood the terms of Seed, Series A and Series B.

Jerry Engel - Professor of HAAS Business School - has played a significant influence on me and 100’s of Australian entrepreneurs and business leaders - he has upskilled them in how to play in the VC world and access the USA market .

Between 2002 and 2008 - the BSI investor forum was one of the only game in town - supported buy innovative government programmes .

There was over a trillion dollars invested in the Superannuation Industry - with nothing being invested in a Aussie Innovation !

In 2002 this was a the state of affairs in Venture Capital . An opportunity waiting to happen ….

It’s taken 20 years to become an overnight success

https://www.slideshare.net/ikayebsi/our-call-for-investment-in-startups-in-2002-13-years-on-the-time-has-come

Things started to take off in 2012 - with the emergence of this loose alliance that was Square Peg supported by the likes of Hostplus and AustralianSuper , and successful individual investors and family offices , many of whom had been entrepreneurs themselves.

An innovation Ecosystem flywheel has been created

A “flywheel” of Aussie Innovation seems to have been created with

More founders

More funding

More Tech service providers

More talent

More exits

The Flywheel isn’t just spinning, it is constantly reinforcing itself (more like spokes than a centreless wheel)

The flywheel doesn’t spin so neatly in one direction. Each element reinforces the others, where each component support one another, contributing to breakout businesses, with each win creating further wins.

It’s all about relationships

Ecosystems rely on talent and capital - which move in dense, experienced circles - and is greased by relationships.

To many it’s seems like a closed shop ….. Why Silicon Valley succeeded was the ability to connect, and openly collaborate with a view to contribute . People shared ideas and built on precious successors - not only of their own technology - but often of their competitors .

The power of connection, collaboration and contribution have been powering the wheels of success of The Australian Tech Ecosystem - Being held together by the glue of University programs, Government support, incubators, accelerators, co-working spaces, informal and formal networking groups, meetups and conferences such as the #bbgforum’s

This infrastructure helps “grease the flywheel” , and “accelerate the hockey stick curve” enabling founders to start businesses, find resources, learn from each other, hire talent, and share war stories.

The flywheel effect of the combined elements supporting each other is contributing to breakout Australian businesses. These massive wins are creating more wins.

Taking a leaf out of Silicon Valley

It seems like a repetition of the Silicon Valley flywheel in the 20th Century and early 21 Century - with investments into Microsoft, Apple, Intel , Oracle, Google, Facebook, Amazon, Yahoo that have spurred countless others.

The People and Players in the Ecosystem - relationships are key

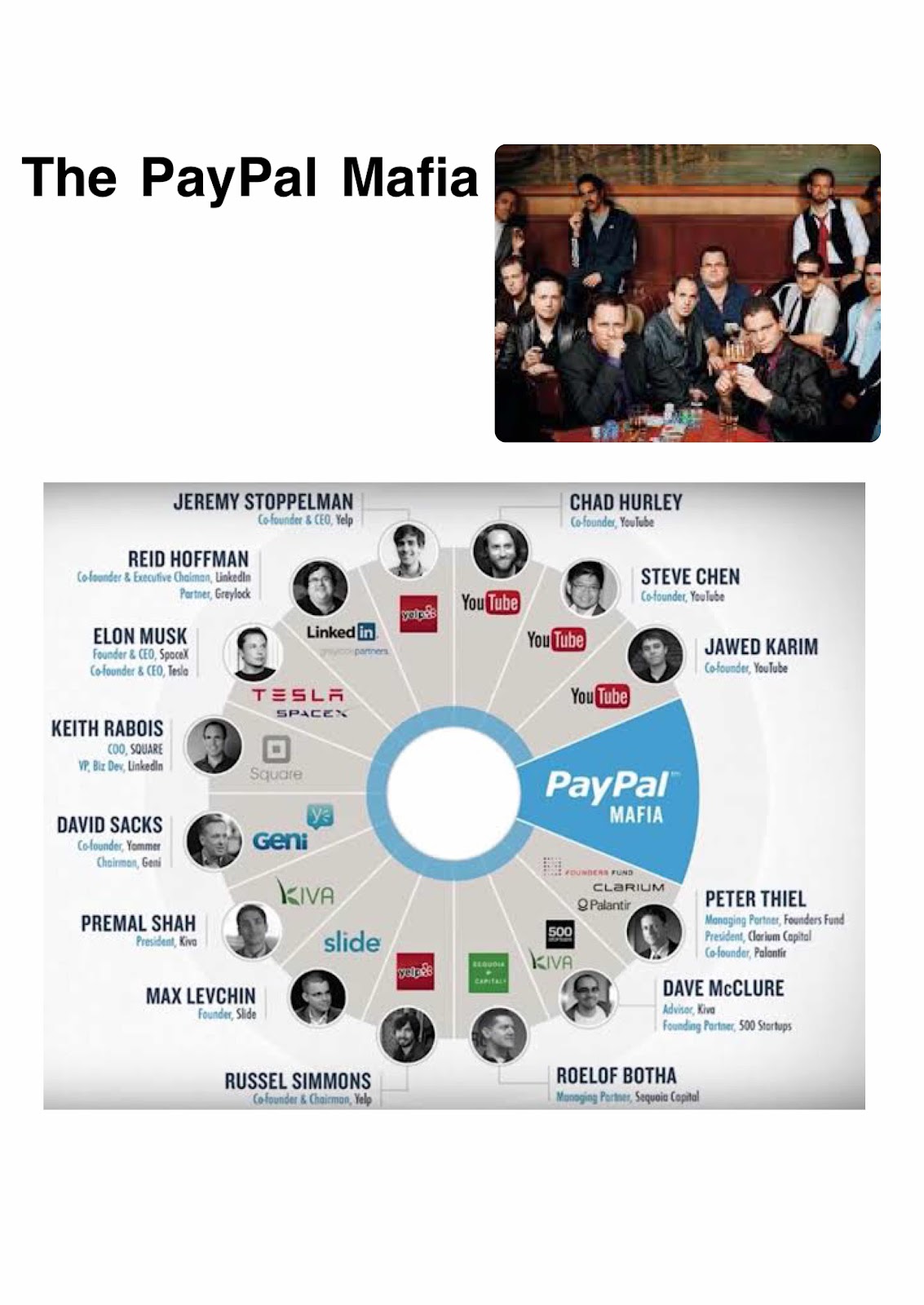

Silicon Valley had a number of “hubs and networks - one of the most famous being the PayPal Mafia of Reid Hoffman, Elon Musk , Peter Thiel and Steve Chen went on to build OpenDoor, Linkedin, Tesla and You Tube . They played a massive part in collaborating, supporting and being supported by each other .

Silicon Valley had a number of “hubs and networks - one of the most famous being the PayPal Mafia of Reid Hoffman, Elon Musk , Peter Thiel and Steve Chen went on to build OpenDoor, Linkedin, Tesla and You Tube . They played a massive part in collaborating, supporting and being supported by each other .

In Australia - you have the early players whose names are weaved through this exciting brief history Niki Skevak of Blackbird , Paul Bassat, Justin Liberman, Mike Cannon Brookes, Scott Farquhar James Packer , BSI and Ausindustry, Michelle Deaker , CSIRO’s Larry Marshall , Bob Beaumont ,(https://www.afr.com/companies/angels-with-empty-pockets-19990423-kb53e) , The 10 government funded BIts Incubators - including BSIs Australian Distributed Incubator and Ron Fink’s Momentum .

Then there is

Leigh Jasper of Aconnex

Martin Hosking of Redbubble

Andrew Spykes of Second Quarter Ventures

Then there are the likes of Ben Pfisterer, APAC lead at Square founded Zeller, Benjamin and Bradley left senior roles at Atlassian to build Dovetail. Jon from Culture Amp founded Pyn, and his Co-Founder, Joris, was an executive at Atlassian.

Today, many of Australia's most senior executives are leaving traditional industries in droves, abandoning the law, consulting, medicine and banking, to start or join startups.

Senior NAB executives, Nathan Walsh and Mike Starkey, founded Athena Home Loans;

Surgeon Manuri. Gunawardena founded HealthMatch,

Former CEO at AMP, Sally Bruce, joined as COO/CFO of Culture Amp.

It all starts with the Founders

Dan Krasnostein, VC at Square Peg says that it all starts with the founders , “the crazy ones” - that are committed to solving massive problems they just can’t bear to see exist in the world.

Failure is not seen as the “end of a career”

In Australia, founders that didn’t ‘make it’ on their first attempt were often blacklisted. Australians seem to now reward founders who can take the experience and lessons from one company into another.

An exciting future for Venture Capital in Australia

Venture Capital in Australia seems to be coming out of its infancy, and I for one am looking forward to the next decade of Australian Innovation - with tools such as BBG and Referron to support the Industry

Wishing you happy holidays and an amazing decade of Connection , Collaboration and Contribution - to continue to make this Community great!

Inspired by the Australian Tech: